This doesn’t mean that anyone who wants to assume one of these loans will be approved. Visit our mortgage education center for helpful tips and information. Fha, va, and usda loans are eligible for assumable mortgages.

How to Login to Chase Mortgage Account Chase Mortgage Login 2022

An assumable mortgage is a home loan that can be transferred from the original borrower to the subsequent homeowner.

The interest rate stays the same.

Apply for a mortgage or refinance your mortgage with chase. View today’s mortgage rates or calculate what you can afford with our mortgage calculator. Visit our education center for homebuying tips and more. We have a potential seller that has an existing chase mortgage that wants to sell her extra house. i saw assume show up somewhere on the chase mortgage website, and got the idea stuck in my head that maybe we could do this.

Fha and va loans are fully assumable and cannot be called due unless the borrower violates the terms of the note. Some conventional loans can be assumed as well, with bank approval. Conventional loans with a due on sale clause are the type of loan that can be called due, as most of these are done without bank approval. Are fha loans through chase assumable?

Yes, fha loans through chase are generally assumable, provided the buyer meets the necessary qualification criteria.

However, specific terms and conditions may apply, so it's important to review the mortgage agreement. What fees are associated with assuming a chase mortgage? Chase is not registered with the superintendent of financial services. We would like to show you a description here but the site won’t allow us.

Mortgage discount points are one way to reduce your interest rate by paying for points during the closing of your loan. One point costs 1% of your mortgage amount and can reduce your interest rate by about.25%, meaning a lower monthly payment over the life of the loan. An assumable mortgage is a type of home loan that allows a buyer to take over, or “assume,” the seller’s existing mortgage, including its interest rate, terms, and remaining balance. Instead of applying for a new home loan with today’s mortgage rates and terms, the buyer steps into the seller’s position as the borrower and continues

Learn more about how mortgage recast works and if it's a right option for you.

See if you qualify for a home loan recast. Buyers can’t assume conventional mortgages, in most cases: To assume a mortgage, start by contacting the lender to make sure the mortgage is assumable, since many lenders prohibit buyers from taking over an existing mortgage. If the mortgage is assumable, you’ll have to complete an application with information such as your income and the value of your assets.

Assumable mortgages, where the seller’s outstanding loans on the property transfer to the buyer, may also be possible in some cases. Here’s a quick review of what types of home loans are assumable: Fha, va, and usda loans. These loans are typically not assumable unless the specific mortgage agreement allows it.

The amount you save on a refinanced mortgage may vary by loan.

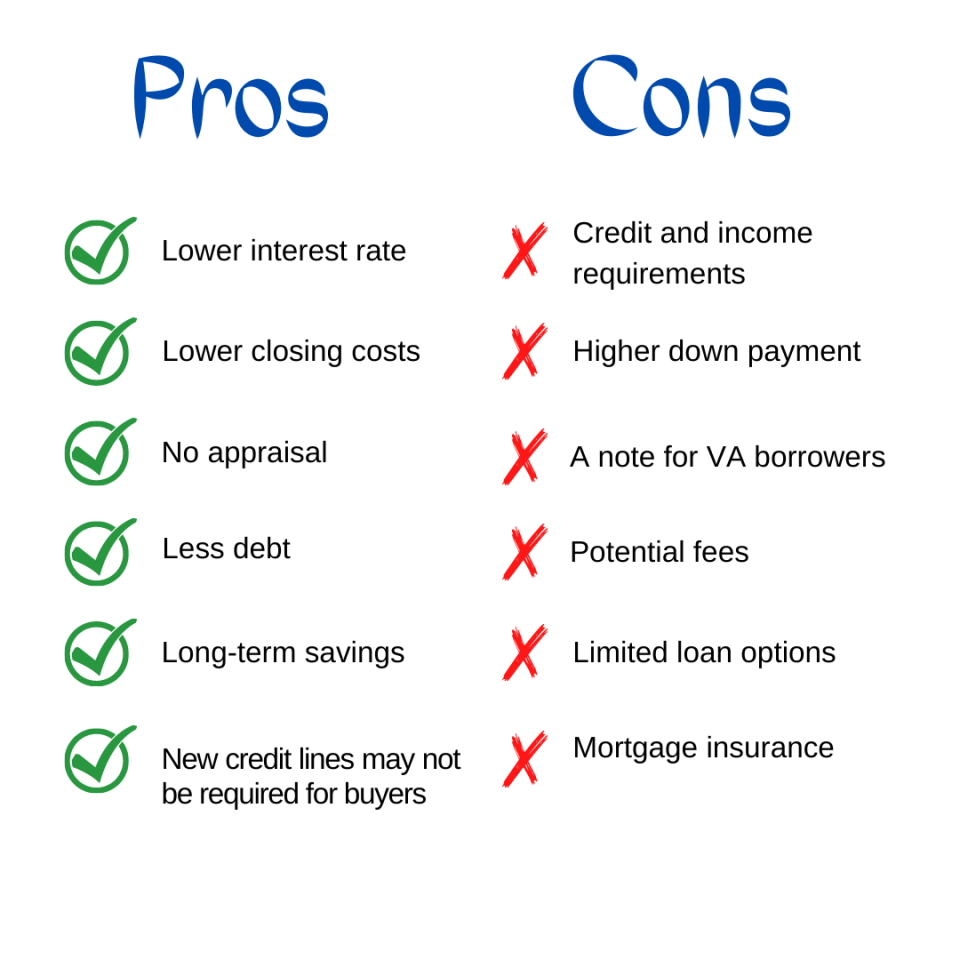

If a refinanced mortgage has a longer term than remains on your current loan, you will incur additional interest charges for the extended term. All home lending products except irrrl (interest rate reduction refinance loan) are subject to credit and property approval. Our affordable lending options, including fha loans and va loans, help make homeownership possible. Check out our affordability calculator, and look for homebuyer grants in your area.

Visit our mortgage education center for helpful tips and information. And from applying for a loan to managing your mortgage, chase myhome has you covered. Insurance products are made available through chase insurance agency, inc. (cia), a licensed insurance agency, doing business as chase insurance agency services, inc.

Certain custody and other services are provided by jpmorgan chase bank, n.a.

An assumable mortgage is a home loan that can be transferred from the original borrower to the subsequent homeowner. The interest rate stays the same. Having an assumable loan can give a home If that loan has a low interest rate, you can sit back and enjoy the perks of having a rate far below what the current market offers.

An assumable mortgage allows another party to take over the remaining payments on a mortgage loan, while keeping the existing loan rate, repayment period, principal balance and other terms intact. The rights and obligations of the original loan are essentially ported from one borrower to another without a new mortgage being created. Explore our affordable mortgage and refinancing options including fha, va and chase dreamaker. Find low down payments and grants to help you buy your new home.

• ‘assume’ the original mortgage.

This can be a great option if your existing mortgage allows for a loan assumption. This makes sense when you have good rate and payment terms on your existing mortgage. Of the options, an assumable mortgage is the one that people have the most questions on in my experience. This also happens to be the

A mortgage or home loan calculator is a digital tool that estimates your monthly payment and the terms of your mortgage. The calculator offers personalized recommendations that may include: Projected monthly mortgage payments, including a breakdown of principal and interest, property tax, homeowners insurance , potential homeowners association Our affordable lending options, including fha loans and va loans, help make homeownership possible.