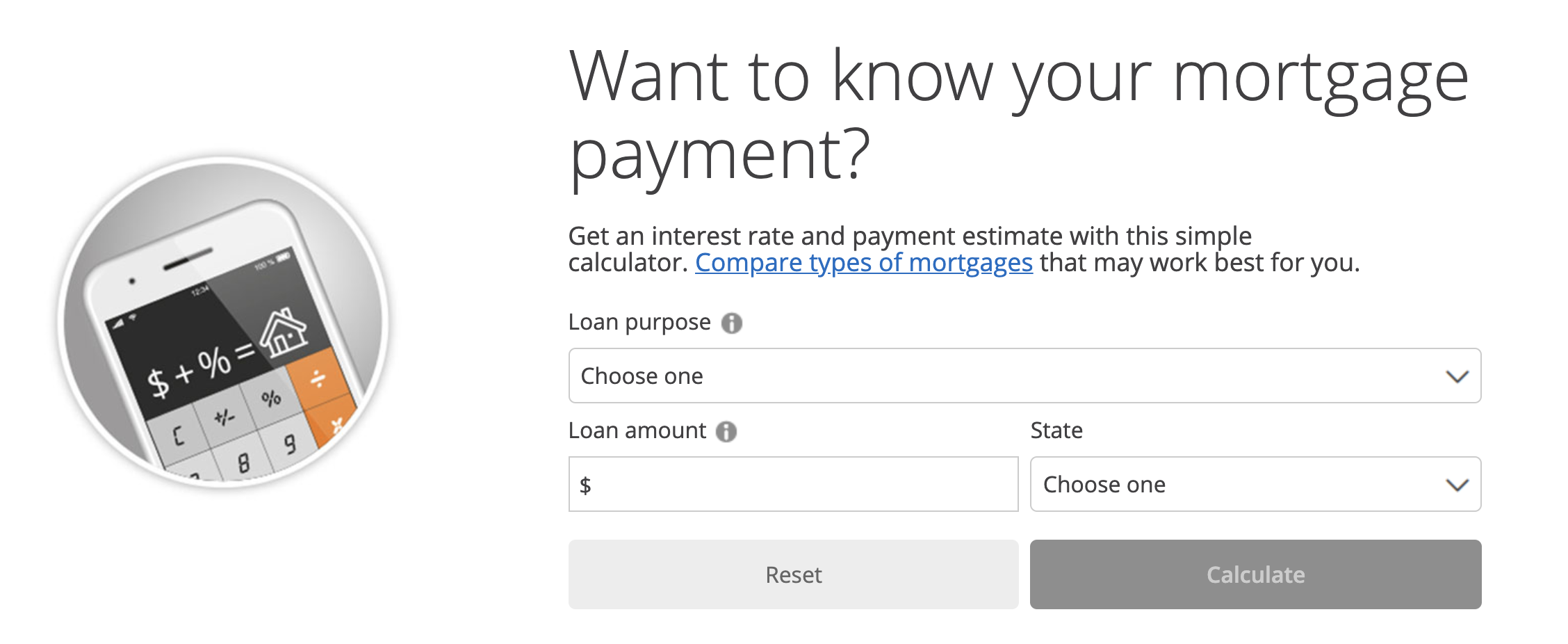

The loan has a new, higher monthly payment that includes a portion of the balance due for a set period of time. The calculator results will automatically update as you move the sliders or leave a text field. With chase myhome, ®, it’s easy to find your loan balance, home values, equity, escrow and other helpful details in one easy to use dashboard.

Chase Mortgage and Home Equity review Top Ten Reviews

No complicated paperwork to manage or widespread info to juggle.

Your actual rate, payment and costs could be higher.

Get an official loan estimate before you choose a loan. Find out the different ways you can manage your mortgage or home equity accounts at chase These articles are for educational purposes only and provide general mortgage information. Products, services, processes and lending criteria described in these articles may differ from those available through jpmorgan chase bank n.a.

Or any of its affiliates. Chase home lending mortgage options to purchase or refinance a home. Speak with a lending advisor near you, schedule a consultation or see if you prequalify. Looking for home lending help?

You've come to right place.

Contact chase mortgage or chase home equity to get information and help managing your account. Discover tools and insights to grow your homeownership confidence. Chase is here to help at every point of your mortgage journey. The amount you should spend on a house will likely vary based on your financial stability, expenses and future financial goals.

Some aspiring homeowners use 28% of their gross monthly income to help determine a potential budget , while others might speak with a home lending advisor to clarify their mortgage options. Mortgage rates from chase mortgage. Check the most current and competitive mortgage rates when choosing a home loan with chase mortgage. Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit.

Please review its terms, privacy and security policies to see how they apply to you.

Simply put, a conventional mortgage is a loan that's not backed by a government agency, such as the federal housing administration (fha) or veterans affairs (va). For fha loans that originated between august 2, 1985 and january 21, 2015, federal fha guidelines require payoff funds to be submitted on the first day of the month. Chase's mymortgage online portal offers homeowners answers to all their mortgage needs. Learn about scheduling online payments, loan tools, and more.

Chase myhome is a digital platform that helps you at every stage of homeownership, from finding and applying for loans to managing your mortgage and equity. Sign in with your chase account to access home insights, rates, properties, offers and more. Whether you're determining how much house you can afford, estimating your monthly payment with our mortgage calculator or looking for preapproval for a mortgage, we can help you at any part of the home buying process. See our current mortgage rates, low down payment options, and jumbo mortgage loans.

Apply for a mortgage or refinance your mortgage with chase.

View today’s mortgage rates or calculate what you can afford with our mortgage calculator. Visit our education center for homebuying tips and more. See our current mortgage rates, low down payment options, and jumbo mortgage loans. Refinance use our home value estimator to estimate the current value of your home.

Review current mortgage rates, tools, and articles to help choose the best option. Why is the mortgage interest shown on my form 1098 different from last year? The amount of interest you pay may change from year to year, usually because of a change in your interest rate or in the number of payments we received from you during the calendar year. Mail a check or money order with your payment coupon to the address listed on your statement or go to your local chase branch.be sure to send your payment 5 to 7 business days ahead of your due date to allow ample time to reach us before it’s due.

Many potential home buyers are typically unaware of reo properties.

Find a chase home lending advisor. Speak with a lending advisor or schedule a consultation to see if you prequalify. A note about this tool: Move the sliders or enter a number to change the amounts.