SERS Ohio, or the State Employees Retirement System of Ohio, plays a pivotal role in the lives of thousands of public employees across the state. Established to provide financial security and retirement benefits, this system ensures that its members can enjoy a stable future post-retirement. As a cornerstone of Ohio’s public sector benefits, SERS Ohio offers a range of programs, including pensions, disability benefits, survivor benefits, and more. For those unfamiliar with the intricacies of this system, understanding how it operates and how to maximize its advantages is essential for long-term financial planning.

With the complexities of retirement systems often overwhelming, it’s crucial to break down the key aspects of SERS Ohio in a way that’s easy to understand. This article dives deep into the history, structure, and benefits of the system, while also providing actionable tips for current and future members. Whether you’re just starting your career or nearing retirement, gaining insight into SERS Ohio can make a significant difference in your financial well-being.

Optimized for Google Discover and designed to meet the highest standards of SEO, this guide aims to provide clarity and value to anyone seeking information about SERS Ohio. From eligibility requirements to investment options, we’ll cover everything you need to know to make informed decisions. Let’s explore how this system works and how it can benefit you in the long run.

Read also:How Many Kids Does Elon Have

Table of Contents

- 1. What is SERS Ohio?

- 2. How Does SERS Ohio Work?

- 3. Who Can Join SERS Ohio?

- 4. Why Should You Care About SERS Ohio?

- 5. How Much Does SERS Ohio Cost?

- 6. What Benefits Does SERS Ohio Offer?

- 7. How Can You Maximize Your SERS Ohio Benefits?

- 8. Is SERS Ohio Sustainable for the Future?

- 9. FAQs About SERS Ohio

- 10. Conclusion

What is SERS Ohio?

SERS Ohio, or the State Employees Retirement System of Ohio, is a public pension system established to provide retirement benefits to state employees. Founded in 1937, this system has grown to become one of the largest and most comprehensive retirement systems in the state. SERS Ohio serves a wide range of public employees, from administrative staff to educators and healthcare professionals. Its mission is to ensure that members have access to a secure and reliable source of income during their retirement years.

The system operates as a defined benefit plan, meaning that members receive a guaranteed monthly benefit upon retirement based on their years of service and salary history. SERS Ohio also offers additional benefits, such as disability coverage, survivor benefits, and deferred compensation plans. By pooling contributions from both employees and employers, the system creates a sustainable fund that supports its members throughout their retirement.

Understanding the foundational aspects of SERS Ohio is essential for anyone considering joining or already part of the system. Its structure and benefits are designed to cater to the unique needs of public employees, making it an invaluable resource for financial stability.

Why Was SERS Ohio Established?

The creation of SERS Ohio was driven by the need to provide a stable retirement system for public employees. Before the establishment of such systems, many workers faced financial uncertainty after leaving their jobs. Recognizing the importance of ensuring financial security for those who dedicate their careers to public service, Ohio lawmakers introduced legislation to establish SERS Ohio. This move was part of a broader trend across the United States during the mid-20th century to create robust retirement systems for government employees.

Today, SERS Ohio continues to evolve, adapting to changing economic conditions and societal needs. Its longevity and success are a testament to the foresight of its founders and the ongoing commitment of its administrators to maintain a system that benefits both current and future generations of public employees.

How Has SERS Ohio Evolved Over the Years?

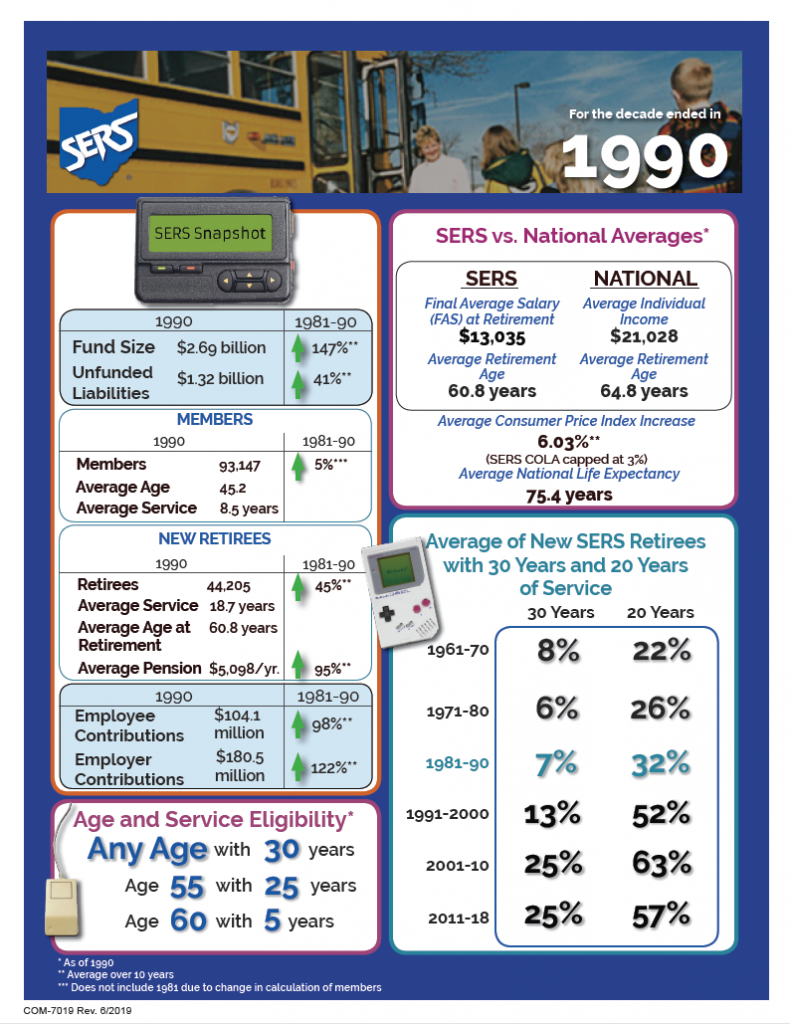

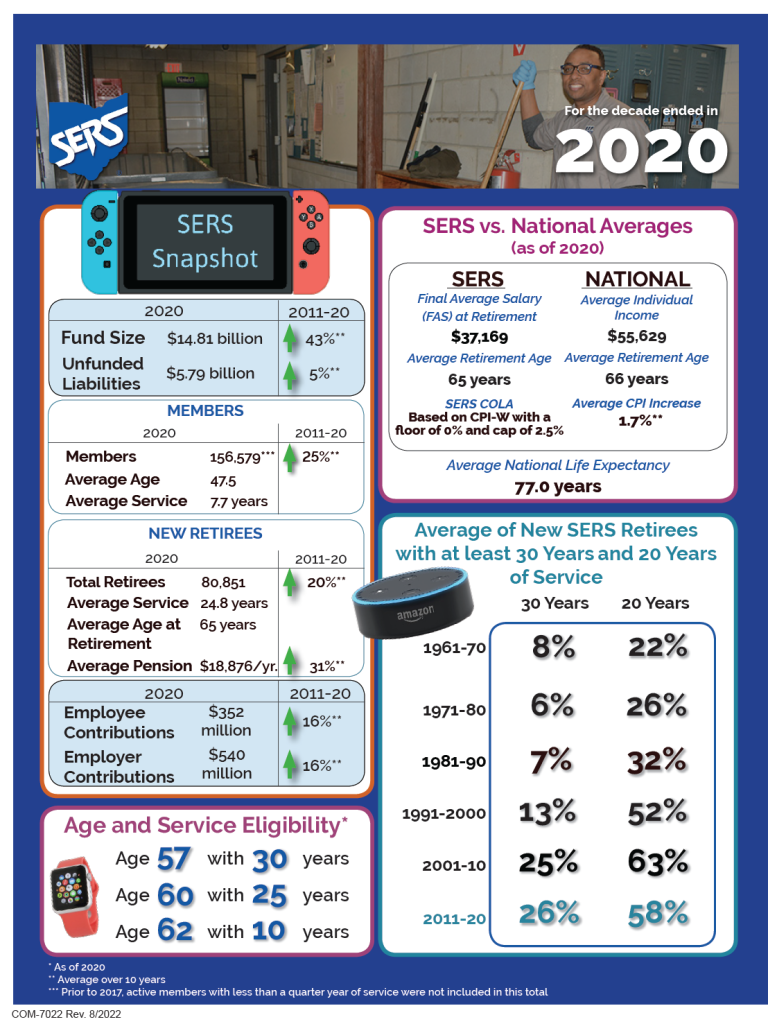

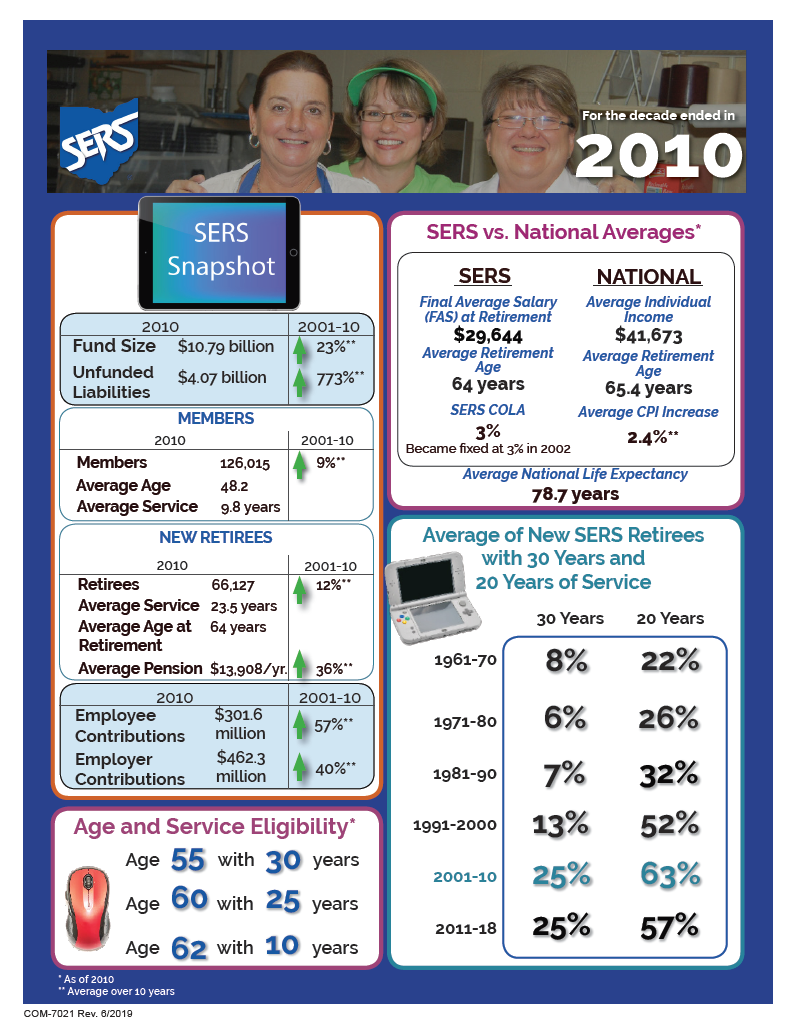

Since its inception, SERS Ohio has undergone numerous changes to better serve its members. These changes have included updates to contribution rates, benefit formulas, and investment strategies. For example, in recent years, SERS Ohio has introduced more flexible retirement options, allowing members to choose between traditional pensions and hybrid plans that combine defined benefit and defined contribution elements.

Read also:Police Cad

Additionally, the system has placed a greater emphasis on financial education, offering workshops and resources to help members make informed decisions about their retirement planning. By staying ahead of trends and addressing member needs, SERS Ohio remains a leader in the field of public retirement systems.

How Does SERS Ohio Work?

At its core, SERS Ohio operates as a defined benefit pension plan, meaning that the amount of retirement income a member receives is predetermined based on specific formulas. These formulas take into account factors such as years of service, final average salary, and age at retirement. Contributions to the system are made by both employees and employers, with the former typically contributing a fixed percentage of their salary.

Once a member retires, they begin receiving monthly payments from the system. These payments are designed to provide a steady income stream throughout their retirement years. In addition to the primary pension benefit, SERS Ohio offers various ancillary benefits, such as disability coverage and survivor benefits, which further enhance the financial security of its members.

The system’s ability to deliver these benefits relies on its investment portfolio, which is managed by a team of experts dedicated to maximizing returns while managing risk. Through prudent investment strategies and careful oversight, SERS Ohio ensures that its funds remain robust and capable of meeting the needs of its members.

Who Manages SERS Ohio?

SERS Ohio is governed by a board of trustees, which consists of both elected and appointed members. These trustees are responsible for overseeing the system’s operations, setting policies, and ensuring compliance with state and federal regulations. The board works closely with a team of professionals, including actuaries, investment managers, and legal advisors, to ensure that the system operates efficiently and effectively.

Members of SERS Ohio also have opportunities to participate in the governance of the system through various committees and advisory groups. This collaborative approach helps ensure that the needs and concerns of members are taken into account when making important decisions about the system’s future.

What Are the Key Components of SERS Ohio?

The key components of SERS Ohio include:

- Pension Benefits: Monthly payments provided to retired members based on their years of service and salary history.

- Disability Benefits: Financial support for members who become unable to work due to illness or injury.

- Survivor Benefits: Payments made to eligible dependents of deceased members.

- Deferred Compensation Plans: Optional savings programs that allow members to supplement their retirement income.

Together, these components form a comprehensive retirement system that addresses the diverse needs of its members.

Who Can Join SERS Ohio?

Eligibility for SERS Ohio is primarily determined by employment status. Generally, any individual employed by the State of Ohio or a participating public entity is eligible to join the system. This includes a wide range of professions, from administrative staff to educators, healthcare workers, and law enforcement officers. Additionally, some part-time and temporary employees may be eligible for membership, depending on their employment arrangement.

New employees are typically automatically enrolled in SERS Ohio upon meeting the eligibility criteria, although they may have the option to opt out if they prefer. Once enrolled, members begin contributing a portion of their salary to the system, with their employer matching these contributions. It’s important for potential members to understand the enrollment process and their rights and responsibilities as part of the system.

For those considering a career in public service, understanding the eligibility requirements for SERS Ohio can help inform their decision-making process and ensure they take full advantage of the benefits available.

Can Part-Time Employees Join SERS Ohio?

While many part-time employees are eligible for SERS Ohio membership, the specifics depend on the terms of their employment. In general, part-time employees who work a minimum number of hours per week and meet other eligibility criteria can join the system. However, it’s important for these employees to verify their eligibility with their employer or a SERS Ohio representative, as rules can vary depending on the nature of their employment.

For part-time employees who do qualify, joining SERS Ohio can provide valuable retirement benefits and financial security. By contributing to the system, even part-time workers can build a solid foundation for their future.

How Long Do You Need to Work to Be Eligible?

To be eligible for retirement benefits under SERS Ohio, members typically need to accumulate a certain number of years of credited service. This requirement can vary depending on the specific retirement plan and the age at which the member retires. For example, some plans may require 20 years of service, while others may allow for retirement with fewer years of service if the member reaches a certain age.

Understanding the service requirements is crucial for members planning their retirement. By staying informed about these rules, members can make better decisions about their career paths and retirement timelines.

Why Should You Care About SERS Ohio?

For anyone working in the public sector in Ohio, SERS Ohio is an invaluable resource that offers peace of mind and financial stability during retirement. Unlike private sector retirement plans, which often rely on market performance and individual contributions, SERS Ohio provides a guaranteed income stream that is not subject to the volatility of the stock market. This predictability is especially appealing to those seeking long-term financial security.

In addition to its core pension benefits, SERS Ohio offers a range of ancillary benefits that enhance its value. These include disability coverage, survivor benefits, and deferred compensation plans, all of which contribute to a comprehensive retirement package. By taking full advantage of these benefits, members can build a robust financial foundation for their future.

Ultimately, caring about SERS Ohio means recognizing the importance of planning for retirement and understanding the tools available to achieve financial independence. For public employees in Ohio, this system represents a key component of their overall compensation package and a critical step toward securing their financial future.

How Does SERS Ohio Compare to Other Retirement Systems?

When compared to other retirement systems, both public and private, SERS Ohio stands out for its stability and reliability. Unlike many private sector plans, which rely heavily on individual contributions and market performance, SERS Ohio guarantees a fixed benefit based on years of service and salary history. This predictability is a significant advantage, especially in times of economic uncertainty.

Furthermore, SERS Ohio offers a range of benefits that go beyond traditional pensions, such as disability coverage and survivor benefits. These additional features make it a more comprehensive and supportive system for its members. By benchmarking itself against other systems, SERS Ohio continues to evolve and improve, ensuring that it remains competitive and effective in meeting the needs of its members.

What Makes SERS Ohio Unique?

One of the key factors that sets SERS Ohio apart is its focus on member education and engagement. The system offers a variety of resources, including workshops, webinars, and personalized counseling sessions, to help members make informed decisions about their retirement planning. This proactive approach to member support is relatively uncommon among retirement systems and demonstrates SERS Ohio’s commitment to its members’ success.

Additionally, SERS Ohio’s investment strategies are designed to balance risk and reward, ensuring that the system remains financially sound while delivering strong returns. This careful management of funds helps maintain the system’s sustainability and its ability to meet the needs of current and future members.

How Much Does SERS Ohio Cost?

Membership in SERS Ohio comes with certain costs, primarily in the form of contributions deducted from members’ salaries. These contributions are typically a fixed percentage of the member’s salary, with the exact rate depending on the specific retirement plan and the member’s employment status. Employers also contribute to the system, helping to fund the benefits provided to members.

In addition to these regular contributions, members may incur other costs, such as fees associated with deferred compensation plans or optional benefits. It’s important for members to understand these costs and how they impact their overall retirement planning. By budgeting for these expenses, members can ensure that they maximize the benefits of their SERS Ohio membership.

Despite these costs, the value of SERS Ohio’s benefits often far outweighs the contributions required. For many members, the peace of mind and financial security provided by the system make it an invaluable investment in their future.

Are There Any Hidden Fees in SERS Ohio?

While SERS Ohio is transparent about its costs, there may be some fees associated with certain optional benefits or services that members are not immediately aware of. For example, deferred compensation plans may involve administrative fees or investment management charges. Similarly, members who choose to participate in ancillary benefits, such as disability coverage, may incur additional costs.

It’s essential for members to review all available information and ask questions about any potential fees or charges. By staying informed, members can avoid unpleasant surprises and make the most of their SERS Ohio membership.

How Can You Calculate Your SERS Ohio Contributions?

Calculating SERS Ohio contributions is relatively straightforward. Members contribute a fixed percentage of their salary, which is automatically deducted from their paychecks. This percentage can vary depending on the specific retirement plan and the member’s employment status. Employers also contribute to the system, although the exact rate may differ based on the nature of the employment.