Receiving a tax refund is one of the highlights of the year for many taxpayers, but what happens when the IRS blocks your refund due to an error? This article explores the reasons behind IRS errors, how they affect taxpayers, and the steps you can take to resolve the issue. If you've experienced a situation where your $11k tax refund was blocked by the IRS, you're not alone.

The Internal Revenue Service (IRS) is responsible for processing millions of tax returns each year, and while the system is designed to be efficient, errors do occur. These errors can range from simple data entry mistakes to more complex issues involving identity theft or fraud. Understanding the root cause of these errors and knowing how to address them is crucial for taxpayers who want to ensure they receive their rightful refunds.

In this article, we will delve into the specifics of IRS errors, including why they happen, how they impact refunds, and what steps taxpayers can take to rectify the situation. By the end of this guide, you'll have a comprehensive understanding of the issue and the tools needed to navigate the process effectively.

Read also:Elon Musk Fat

Table of Contents

- Introduction to IRS Errors

- Common IRS Errors That Block Refunds

- Identity Theft and Its Impact on Refunds

- Fraudulent Tax Returns: A Growing Concern

- Steps to Resolve IRS Errors

- Effective Communication with the IRS

- Legal Options for Taxpayers

- Preventing Future IRS Errors

- Resources for Taxpayers

- Conclusion and Call to Action

Introduction to IRS Errors

IRS errors are not uncommon, especially during peak tax filing seasons. These errors can range from minor issues like incorrect Social Security numbers to major problems like identity theft. When an error occurs, it can lead to the blocking of tax refunds, leaving taxpayers frustrated and confused. Understanding the mechanisms behind these errors is the first step toward resolving them.

IRS Error Blocks $11k Tax Refund is just one example of how significant these issues can be. For taxpayers who rely on their refunds for financial stability, such errors can have a profound impact on their lives. This section will explore the most common types of IRS errors and their potential consequences.

Why IRS Errors Happen

IRS errors can occur due to a variety of reasons, including:

- Human error during data entry

- System glitches or software malfunctions

- Incomplete or incorrect information on tax returns

- Identity theft or fraudulent activity

Common IRS Errors That Block Refunds

There are several common IRS errors that can lead to blocked refunds. These errors can arise from both taxpayer mistakes and IRS processing issues. Understanding these errors can help you identify the problem and take appropriate action.

Incorrect Personal Information

One of the most frequent IRS errors is the mismatch of personal information, such as Social Security numbers or names. This can happen if the taxpayer provides incorrect details or if the IRS fails to update records accurately.

Mathematical Errors

Mathematical errors in tax calculations can also lead to blocked refunds. Even a small miscalculation can trigger an IRS review, which may delay or block the refund process.

Read also:Jadiann Thompson Husband A Comprehensive Guide To His Life And Career

Identity Theft and Its Impact on Refunds

Identity theft is a growing concern for taxpayers and the IRS alike. When someone files a fraudulent tax return using your personal information, the IRS may flag your legitimate return as suspicious, leading to a blocked refund.

IRS Error Blocks $11k Tax Refund can often be traced back to identity theft. In such cases, taxpayers must work closely with the IRS to verify their identity and resolve the issue.

Steps to Prevent Identity Theft

- Protect your personal information

- Monitor your credit reports regularly

- File your tax return early to beat potential fraudsters

Fraudulent Tax Returns: A Growing Concern

Fraudulent tax returns are a significant problem for the IRS. Criminals often use stolen identities to file false returns and claim refunds. This not only affects the IRS but also the legitimate taxpayers whose identities are stolen.

The IRS has implemented several measures to combat fraudulent returns, including enhanced security protocols and identity verification processes. However, taxpayers must remain vigilant and report any suspicious activity promptly.

Steps to Resolve IRS Errors

Resolving IRS errors can be a challenging process, but it is essential to ensure you receive your rightful refund. Here are some steps you can take:

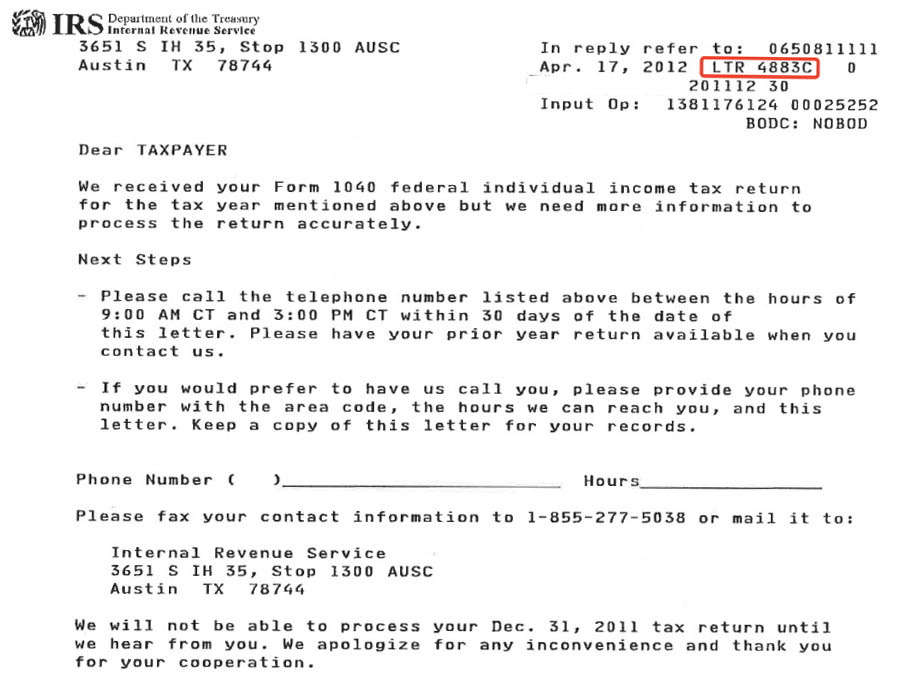

Contact the IRS

The first step is to contact the IRS directly. You can do this by calling their toll-free number or visiting one of their local offices. Be prepared to provide documentation to support your case.

Submit an Amended Return

If the error is on your side, you may need to file an amended return (Form 1040-X). This form allows you to correct errors and provide additional information to the IRS.

Effective Communication with the IRS

Effective communication is key when dealing with IRS errors. Here are some tips to ensure your interactions with the IRS are productive:

- Keep detailed records of all communications

- Be polite and professional in all interactions

- Provide all requested documentation promptly

Legal Options for Taxpayers

In some cases, taxpayers may need to seek legal assistance to resolve IRS errors. Tax attorneys and certified public accountants (CPAs) can provide guidance and representation in dealing with the IRS. They can help you navigate complex legal issues and ensure your rights are protected.

Preventing Future IRS Errors

Preventing IRS errors requires careful attention to detail when filing your tax return. Here are some tips to help you avoid common mistakes:

- Double-check all personal information

- Use tax preparation software to minimize errors

- Keep copies of all tax documents

Resources for Taxpayers

There are several resources available to taxpayers who are dealing with IRS errors:

Conclusion and Call to Action

IRS errors, such as those that block $11k tax refunds, can be frustrating and stressful for taxpayers. However, by understanding the causes of these errors and taking proactive steps to resolve them, you can ensure you receive your rightful refund. Remember to stay informed, communicate effectively with the IRS, and seek professional assistance if needed.

We encourage you to share this article with others who may be facing similar issues. Your feedback and comments are valuable to us, and we invite you to explore other articles on our website for more information on tax-related topics.